E-Commerce Trends Analysis

Background and overview

Amazon is a multinational American tech company with a diverse range of business operations, including e-commerce. In this area, they manage the entire process, from purchasing and storing inventory to handling shipping, pricing, customer service, and returns.

It's one of the world's largest companies, they collect and analyzes data on customer behavior, preferences, and trends to optimize product recommendations, pricing strategies, and logistics. With its reach spanning over 200 countries, Amazon manages an enormous volume of shipping and delivery data, ensuring efficiency through advanced algorithms and AI-driven systems. The objective of this project is to perform meaningful analysis, understand sales trends, customer behavior and product performance over states with a data set of 120,000 clothing sales entries in India during 2022.

Insights and recommendations are provided in the following key areas:

-

Analyze Sales and Revenue Trends: Monitor sales and revenue performance every week to identify seasonal trends, calculating the Growth Rate (%) for revenue and sales during the specified periods.

-

Identify Sales Performance by State: Analyze total sales by state to understand which regions generate the highest revenues each month, focusing on Total Revenue (in USD) per State and Average Order Value (AOV) per State.

-

Product Category Performance: Evaluate the top-selling product categories over the months. Determine whether a small number of categories are responsible for the majority of the revenue, helping to identify the most impactful products driving overall sales performance.

-

Categorize Successful vs. Unsuccessful Orders: By analyzing the Status column, we can categorize orders as successful or unsuccessful and assess their impact on overall sales through key metrics such as Total Sales, Conversion Rate, and Lost Revenue. Additionally, we can analyze the states with the highest number of unsuccessful deliveries, providing insights into regional performance and potential areas for improvement.

Further links of the project

Data Structure Queries

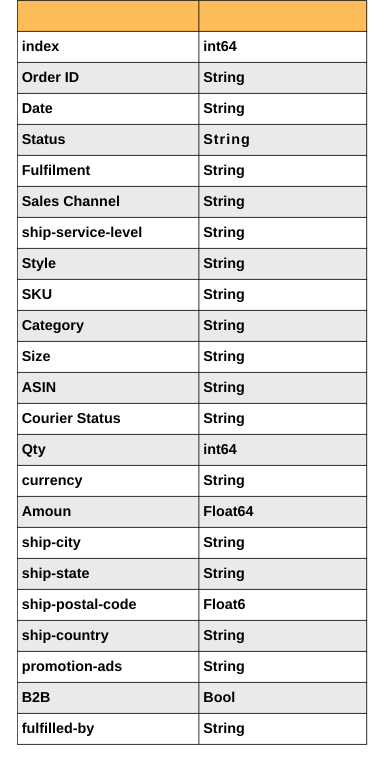

The dataset under analysis contains information about sales transactions, including details such as dates, statuses, fulfillment methods, sales channels, product categories, quantities, shipping destinations (including state and postal codes), and amounts. The dataset spans only four months of the year (March to June), and the data contains multiple order statuses, indicating various stages of order completion (e.g., "Shipped," "Cancelled," "Delivered to Buyer," etc.).

One of the challenges with the dataset is dealing with incomplete or unsuccessful transactions as indicated by the Status column. Orders that were canceled or returned to the seller do not reflect actual sales, and if not handled correctly, they could skew the analysis. Additionally, the lack of unique customer IDs and the use of postal codes as a substitute can introduce complications when analyzing repeated purchases by the same customer.

Insights of the analysis

Summary of findings

Sales and revenue trends in April showed significant volatility, with sharp spikes early in the month, followed by steep declines and brief recoveries, ultimately ending on a downward trend. Maharashtra and Karnataka were the top revenue-generating states, while regions like Ladakh and Lakshadweep had the highest Average Order Values (AOV). In terms of product categories, Kurta and Set dominated sales, together generating 80% of the total revenue, with other categories contributing marginally. Unsuccessful deliveries resulted in a lost revenue of nearly 8.93 million, with Maharashtra, Karnataka, and Telangana facing the highest delivery challenges.

Insights Deep Dive

-

Sales and Revenue Trends

Sales growth throughout April shows extreme fluctuations. It begins with a remarkable spike in week 15, reaching 278.07%, but quickly drops over the next few weeks, turning negative by week 17 at -1.31%. Sales recover briefly in week 19 with 16.22%, but this is followed by a sharp decline in week 20 (-29.77%) and a drastic drop in week 23 (-54.31%). There is a strong rebound in weeks 23 and 24, where sales growth soars to 87.16%. However, the trend reverses again, with sales falling back into negative territory by week 26 and ending at -57.65% in week 28.

Revenue growth mirrors the erratic pattern of sales. It starts high at 276.79% in week 15, but by week 17, revenue growth slips to 0.77%. A temporary recovery in week 19 (13.13%) is followed by a significant drop to -31.79% in week 20 and a steep decline of -54.88% in week 23. Like sales, revenue rebounds strongly in weeks 23 and 24, peaking at 86.25%, before falling again in the final weeks, ending at -58.95% in week 28. Overall, revenue growth exhibits large swings between strong gains and deep losses.

-

Sales performance by state

The states of Maharashtra and Karnataka account for 17% and 13% of the total revenue, respectively, while all other states contribute less than 9% each to the overall revenue.

The map below showcases the Average Order Value (AOV) across states, with Ladakh, Lakshadweep, and Nagaland standing out as the top three regions with the highest AOV and Punjab, Nagaland and Arunachal Pradesh as the lowest.

-

Product category performance

The analysis of sales data reveals that Kurta and Set were the dominant product categories, with Kurta leading slightly at 41,751 units sold and Set closely behind with 41,617 units. Western Dress comes in third with 12,896 units sold, though significantly lower than the top two categories. This trend of Kurta, Set, and Western Dress leading in volume has remained consistent over time. Other categories like Saree, Bottom, and Ethnic Dress only began generating sales in April, with Dupatta following later in June, indicating a staggered start in sales for these categories.

The analysis shows that the two leading product categories, Kurta and Set, were responsible for generating 80% of the total revenue during the analysis period. This distribution follows the Pareto Principle, where a small portion of categories (20%) accounted for the majority of the revenue (80%). The remaining categories, including Western Dress, Top, Saree, Blouse, Bottom, Ethnic Dress, and Dupatta, contributed to the remaining 20% of revenue, further emphasizing the dominance of the top two categories.

-

Unsuccessful deliveries

The overall delivery success rate was 88.6%, resulting in lost revenue of 8,925,726.3 due to unsuccessful deliveries.

The states with the highest number of unsuccessful deliveries are Maharashtra (2,240), Karnataka (1,654), and Telangana (1,196). These states represent the areas with the most significant challenges in delivery success

Recommendations

-

Focus on Top Product Categories: Given that Kurta and Set categories account for 80% of total revenue, resources should be allocated to further optimize inventory, marketing, and pricing for these products. Promotions and recommendations could be tailored around these categories to drive even higher sales. Additionally, understanding customer preferences within these categories can help introduce new variations or complementary products to enhance the product line.

-

Improve Logistics in Key States: Maharashtra, Karnataka, and Telangana not only generate significant revenue but also face the highest delivery challenges. Streamlining logistics in these states through enhanced last-mile delivery solutions, optimizing warehouse locations, and improving delivery forecasting could reduce the number of unsuccessful deliveries and mitigate lost revenue.

-

Enhance Customer Experience in Low AOV States: States like Punjab, Nagaland, and Arunachal Pradesh, which have low Average Order Value (AOV), could benefit from targeted campaigns that encourage higher basket sizes. Offering bundled deals, personalized recommendations, or free shipping thresholds could incentivize larger purchases, improving profitability from these regions.

-

Address Sales Volatility: The significant fluctuations in sales and revenue growth throughout the month suggest potential issues with demand forecasting and inventory management. Using more robust predictive models and AI-driven algorithms to anticipate sales peaks and drops can help balance inventory levels and ensure stock availability, particularly for high-demand categories. Seasonal or promotional patterns should also be leveraged more effectively to maintain steady growth.

-

Expand and Promote Newer Categories: Categories like Saree, Bottom, and Ethnic Dress, which started later in the year, have untapped growth potential. Investing in marketing strategies to increase visibility for these categories, coupled with customer feedback collection to refine the product offerings, can help drive growth and diversification in product performance.

-

Reduce Unsuccessful Deliveries: With a delivery success rate of 88.6%, there is room for improvement in reducing failed deliveries. Implementing AI-driven route optimization, improving customer communication for address confirmation, and offering more flexible delivery options could help improve the success rate, ultimately reducing revenue losses from unsuccessful deliveries.